Many sellers require a buyer to produce a sales return authorization number before its receiving department will accept a return. A return authorization number — or RA — allows sellers to track a return from its outset to its end. However, in spite of its product’s popularity, Battery Operated Light Up Hooting Owl Pest Deterrent LLC needs that money as soon as possible.

To calculate net sales, we have to get the total sum of sales allowances, sales returns, and discounts. Because gross sales figures can help you discover a variety of things about your business. By comparing them to gross sales in February and January, we can see fluctuations in gross profit. From these totals we can subtract deductions, such as discounts, allowances, and returns, in order to see what the net sales were.

However, none of these values alone are enough to tell you if your business is healthy or not. Instead, they work together to paint a picture of your company’s financial situation. Potential lenders and investors use both types of revenue to learn about your business model and company management. When you compare the two quarters, you can see that you earned $200k more by offering a discount, even if it meant lower prices and more returns. Square Invoices is a free, all-in-one invoicing software that helps businesses request, track and manage their invoices, estimates and payments from one place.

Gross Sales vs. Revenue

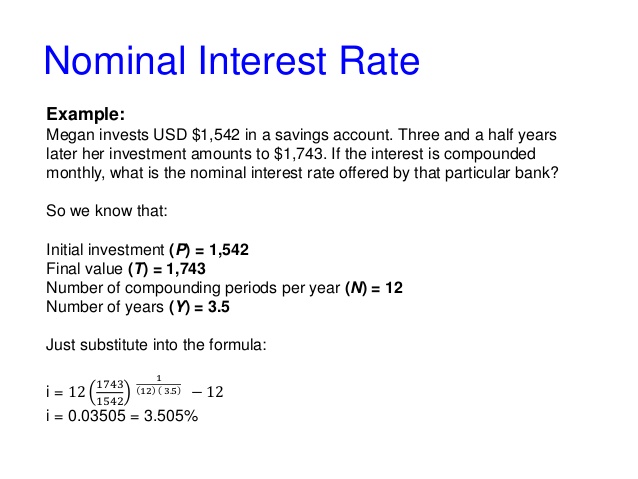

In this context, “sales discounts” doesn’t refer to sales promotions, promotional discounts or rebates and seasonal offers, it only applies to the early payment discount. The exact terms of a discount vary from company to company, but the general idea is to create a mutually beneficial outcome for both parties. The seller gets their invoices paid faster, allowing them to maintain a healthy cash flow, and the customer doesn’t have to pay full selling price. When the income statement is finished, you can use this information to calculate your sales tax and inform your future sales activity. Finally, we’ll assume that there were no sales allowances during this period. For our hypothetical scenario, we’ll assume that a 10% discount was offered to customers that paid early, which was the case in 5% of all completed customer transactions.

- Totaling gross sales is an essential first step to determining a company’s profit.

- This helps to ensure that everyone knows exactly which figure you’re talking about.

- Allowances are typically the result of transporting problems which may prompt a company to review its shipping tactics or storage methods.

- A business might start by declaring its gross sales (commonly referred to as gross profit or total gross revenue), then listing the different sales deductions made as line items (which are the net sales).

This gives your business a healthy cash flow, but if the discount is too high or if too many customers are using it, it can affect your final sales figure. Gross sales and net sales will feature in your financial statements, specifically as the top line on the company’s income statement (also known as a profit and loss statement). When examining gross sales analysts are able to get an idea of the business’s ability to capture overall market share. Additionally, retail chains use gross sales to assist with planning orders and stocking. Gross sales is a useful metric for assessing a business’s ability to generate income. The metric is heavily relied on in the retail industry but is used in other industries as well.

Knowing how to calculate metrics yourself is a great way to get a better feeling for what the numbers are saying. Square’s contactless and chip reader enables you to accept chip cards, contactless (NFC) cards, Apple Pay and Google Pay anywhere. Connect wirelessly, accept credit and debit cards quickly and get money in your bank account fast. Business and accounting, like all specialties, have their jargon and technical terms. Many business terms are used regularly, but it isn’t always clear what they mean – or even if they’re being used properly. You could reach out to the good people over at Battery Operated Light Up Hooting Owl Pest Deterrent, LLC and tell them about your problem.

What are Net sales?

Every calculation done in accounting can tell you something about the health and progress of your business. So while it may seem like a lot of work to track them all, they do all have value. For instance, if there’s a big difference between your Gross Sales and Net Sales, then that might be a sign that there’s something wrong with your product or service. Investigating whether there have been many allowances made or credits issued could tell you that you need to change your production strategies.

Set up a free online store that syncs with your inventory and your social media. Finally, a customer complained that a $200 sweater that was ordered online was damaged in transit. The store was unable to replace it, and the customer would prefer to keep it. As a goodwill gesture, the store agreed to partially refund the customer by 40%. When a customer pays for a product with a minor but noticeable defect, they may get in touch with the company they bought it from and request a retroactive discount.

Free templates to track sales

This is why there are terms like Net Sales and Gross Sales in accounting – so that you can differentiate between all the many similar-sounding words and phrases. This helps to ensure that everyone knows exactly which figure you’re talking about. So, for example, if you made Gross sales vs net sales five sales in a particular reporting period, and they were $5,000, $7,000, $10,000, $3,000 and $1,000 respectively, your Gross Sales would be $26,000. You can measure Gross Sales over any period you choose to, but usually, it’s calculated monthly, quarterly and annually.

In this scenario, a potential investor may decide not to invest even though the company’s gross revenue was increasing. If you want to calculate operating income or gross profit, you’ll use net revenue as the starting point and subtract the relevant expenses. Net sales may be used by outside analysts and investors to determine how the above costs differ between your company and your industry average. It’s useful, certainly, in determining a company’s value and worth; however, it doesn’t begin to represent a company’s profits or even how much money it truly made. It also lets a company hold customers accountable for the state of products they return, the pace at which they do so, and whether they actually purchased the returned goods in the first place. Gross and net revenue are both regularly used in ratios and other metrics to indicate a company’s financial strength and performance.

Gross sales, sales, gross revenue and revenue

The store’s gross sales are the product of the ASP and the number of units sold, which amounts to $8 million in gross sales. For companies that record the deductions, the gross sales and net sales will have to be recorded separately. In this article, you will learn everything you need to know about net sales and gross sales. You will learn about the differences between these two metrics and how to calculate them. Shopify POS has all the tools to help you convert more store visits into sales and grow revenue.

Make more relevant product recommendations, turn abandoned store sales into online sales, and track both store and staff performance from one easy-to-understand back office. To determine whether sales are steadily increasing, we want to compare sales revenue for March 2022 with February 2022. First, we need to determine how many of these top four products have been sold. If your POS dashboard includes discounts and allowances, it might already calculate net sales for you, so you’ll need to figure that out on your own. With Shopify POS, it’s easy to create reports and review your finances including sales, returns, taxes, payments, and more. View your financial data for all sales channels from the same easy-to-understand back office.

Grow your retail business

The buyer wound up being perfectly happy with the product it bought in lieu of the one they originally ordered. After receiving the Battery Operated Light Up Hooting Owl Pest Deterrent in the mail, they decided they didn’t need it. If they promptly returned it with a return authorization number issued by the company, they’d likely get a refund. Say the operations at the Battery Operated Light Up Hooting Owl Pest Deterrent factory ground to a halt, and the company wound up shipping one of its products to a buyer a month late. By that point, the customer had grown frustrated with the number of pests in their backyard and turned to a company that sold battery-operated, laser-eyed, screeching hawk pest deterrents. Here, we’ll take some time to understand what gross and net sales are, what differentiates the two from one another, and what they can show about the health of a business.

- As a sales manager, you can create a plan around working with other teams to address customer concerns and discuss ways to add value to increase profits.

- Companies adjust for write-offs or write-downs on inventory due to losses or damages.

- As we mentioned, gross sales is used heavily in the retail industry, but almost always in conjunction with net sales.

- The difference between Gross and Net Sales is that Gross Sales figures don’t take any of the deductions mentioned above into account.

Although gross sales do not accurately represent a company’s profits, they do provide a baseline for measuring important sales metrics. While gross sales vs. net sales are terms that may be more familiar to accountants and investors, knowing what these mean as a salesperson or sales manager is still vital. It can give you a strong indicator of business performance and help identify any potential issues before they become serious problems. When analyzing any business’s income potential, gross sales are typically examined in close detail.

What are gross sales?

Gross sales represent the total money derived from all sales transactions within an accounting period – without deductions of any kind. Net sales, on the other hand, represents the total figure after the deductions have been made. Calculating your gross sales can also give you a deeper insight into how many units of each product were sold over a period of time. This information can give you a good idea of consumer preferences and buying trends. Returns refers to the monetary value of all returned items, and allowances equals the total value of the discounts offered for the gross sales. Two of the most common figures to track are gross revenue and net revenue.

In this post, we’ll show you how to calculate your net and gross sales so you can create accurate sales forecasts. We’ll walk you through the formulas, outline their differences and show you how to identify issues or opportunities within the sales process. A good place to start is to understand your total sales and revenue, which involves keeping tabs on gross sales and net sales. For example, it is difficult to assess if gross sales are considered high if you do not know the average gross sales for the overall industry or for similar products. Consequently, it is important to be able to pin gross sales against some other information in order to make it more useful. Typically analysts will utilize both gross sales and net sales together to paint a more informative picture of the quality of income a business has.

WWE’s WrestleMania 40 ticket sales show strength of the brand … – Daily Independent

WWE’s WrestleMania 40 ticket sales show strength of the brand ….

Posted: Mon, 21 Aug 2023 13:27:46 GMT [source]

There’s a difference between the two and it’s important to understand the difference in order to get the most out of the data. ACTouch is a Manufacturing ERP Software designed for Manufacturing, Finance and Inventory features for all SMB’s businesses. If you’re just starting to learn more about Accounting terminology, you might have noticed that there are Gross and Net versions of everything. Start off with a powerful ticketing system that delivers smooth collaboration with unlimited room for your customers. Let’s consider our “Battery Operated Light Up Hooting Owl Pest Deterrent” example. If you purchased one of these owls and found that only one of its terrifying laser eyes was lighting up, you might consider returning it.

The difference between gross sales and net sales can be of interest to an analyst, especially when tracked on a trend line. If the difference between the two figures is gradually increasing over time, it can indicate quality problems with products that are generating unusually large sales returns and allowances. To calculate a company’s gross sales, add up the total sales revenue for a specified period of time—monthly, quarterly, or annually. When it comes to measuring business performance, it’s important to understand the difference between gross revenue vs. sales and revenue vs. gross sales. Gross revenue represents the total income generated by a business, while sales refer to the revenue generated from selling products or services. These deductions make the difference between net sales and gross sales.