Hiring a list specialist ensures you’re actively managing your stock levels whereas additionally establishing systems that streamline the method of inventory control. As famous, this helps convey costs down and will increase marginal returns. Once you plug those numbers into the ATS formulation, you get a list ATS total of 3,200 units. Depending on your required inventory ranges, that number may reveal a need for more inventory or be good. For example, it’s essential not to confuse available to sell stock with out there to ship stock. Available to ship stock refers to merchandise that wholesalers have stored of their warehouses which are immediately available to ship to retailers.

FINRA runs dozens of complex surveillance patterns to detect all kinds of compliance points and suspicious conduct to protect investors and to maintain up the integrity of U.S. monetary markets. “Dark pool” is a term usually used to discuss with an ATS that isn’t lit, meaning it doesn’t publicly display the buy/sell value or the number of shares traded, as described above. Dark swimming pools, in general, had been designed to anonymously handle giant trades for institutional investors, and most retail investors won’t immediately work together with dark swimming pools.

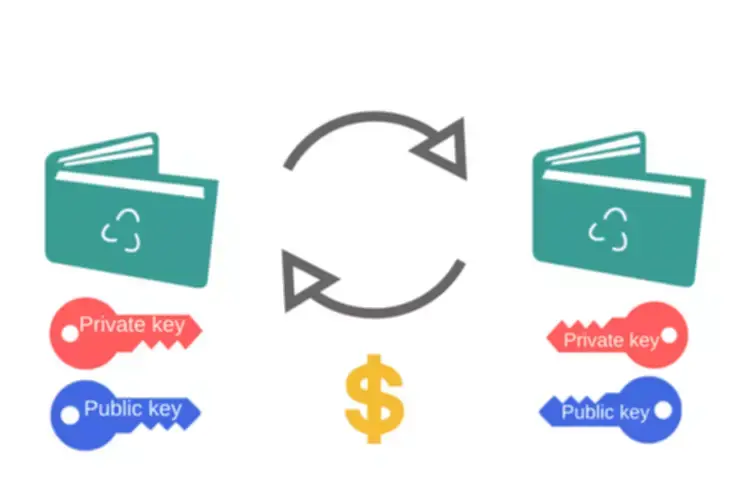

Changes in regulations or failure to adjust to regulatory necessities can pose vital risks. Broker-dealers use ATS to provide their clients with access to extra liquidity and potential price enhancements ats stock meaning. Furthermore, applied sciences corresponding to blockchain are being explored for their potential to enhance transparency, security, and efficiency inside these methods.

Abbreviated as DC, a distribution center is a warehouse or other location with shares product for sale to retailers, wholesalers, or clients. Used to explain product not obtainable for sale because of it being reserved typically for a sales or purchase order. This is typically used at the side of MOQ to determine probably the most value efficient manufacturing of goods. A BOM could additionally be tied to a production order, upon which it will generate reservations on the components in inventory, and a request for order for these that aren’t.

While it is the opposite of top-down forecasting, the two are sometimes used collectively to optimize forecasts. Due to its excessive prices, air ship is often used within the case of speeding up a product’s lead time for an earlier receipt. As a retailer, you at all times need to have your ATS inventory figures readily available. It’s a critical metric that can allow you to account for backorders, stop stockouts, and maximize sales.

Us Sec Regulation Ats

In other words, merchandise that follow the same sales pattern each year for a particular span of weeks, months, or quarters. The reducing of a product’s promoting price, usually by a set proportion. Markdowns are a technique of shifting by way of stale or slow shifting stock sooner. A markdown is totally different from a promotion as it’s considered everlasting till the product sells out. It differs from the landed (direct or standard) cost of inventory.

Dark pools and name markets are significantly cheaper, however the pricing may range for large-volume transactions. In most instances, ATS traders juggle different variations of different techniques to determine the very best worth for their dealings. Regardless of the pricing, all ATS platforms share the benefit of ample liquidity since they are designed to simplify the seek for matching orders.

Ideas For Enhancing Ats Inventory Accuracy

The Securities and Exchange Commission (SEC) acts because the referee. First, things can transfer in a quick time on this platforms, so your trades can occur almost immediately. They may additionally be cheaper than using the standard means of purchasing for and promoting investments. For instance, companies or whale traders with appreciable share volumes may find it tough to sell their stocks in traditional change environments. While the shares will be sold eventually, reaching the end line may take some time. In such cases, the inventory prices decrease with unpredictable market swings and different important factors.

For instance, firm X might wish to concern shares to increase their cash reserves for a specific R&D project. Thus, by acquiring liquidity in a closed-out ATS environment, company X will maintain its share price and continue business as usual. Order execution is another essential factor within the trading landscape.

What Do Alternative Trading Systems Do?

FINRA Data provides non-commercial use of knowledge, particularly the power to save tons of data views and create and handle a Bond Watchlist. While hiring a list specialist may be a substantial value for a small enterprise, the upside is reaping the long-term payoffs that employing an skilled on the matter presents. To precisely handle inventory, categorizing the products you have available is important to efficiently fulfilling orders—whether they’re backorders, pending, or existing orders. “Alternative trading system (ATS)” is the terminology used in the U.S. and Canada. In Europe, they are often recognized as “multilateral buying and selling services.”

Regulators have stepped up enforcement actions towards ATSs for infractions such as trading towards customer order flow or making use of confidential customer buying and selling information. These violations may be extra widespread in ATSs than in national exchanges because ATSs face fewer laws. This amendment was a monumental change from the original Regulation ATS, which solely required broker-dealers to register and be accredited as an ATS by the SEC. Most importantly, the amended Regulation ATS established a formal course of the SEC will use to review and approve/reject submitted ATS-N forms. Form ATS-N has been made publicly available by the SEC and could be accessed utilizing its EDGAR system. While both ATS and traditional exchanges serve the basic purpose of facilitating securities buying and selling, they differ in many respects.

Examples Of Ats

U.S. securities markets have grown more advanced over the years. But while there are variations amongst types of execution venues, they all have an obligation to report post-trade information. All buyer trades, regardless of where they’re executed, are subject to SEC and FINRA guidelines and laws designed to protect traders, together with these pertaining to finest execution and extra.

The most outstanding flaw of ATS platforms is the dearth of appropriate laws related to cost manipulation. Since ATS platforms are mostly nameless, it isn’t easy to make sure honest pricing, and tons of firms have sued ATS platforms for this very concern. Price discovery is primarily facilitated in a dark setting that forestalls traders from having tangible knowledge. Thus, firm X might concern shares for $80, believing it’s the greatest price obtainable https://www.xcritical.com/ in the marketplace, whereas the precise truthful price might be $100. [newline]Investor X can’t know this and can lose 25% of their potential cash circulate. Data recorded under comparable sufficient situations to present and future time durations such that it can be used to forecast future demand. For instance, information recorded in Q1 of this 12 months may be thought-about related historical past for a projection of Q1 of the following year.

A inventory exchange is a heavily regulated market that brings collectively buyers and sellers to commerce listed securities. Moreover, significant share points are sometimes brought on by the company’s need to acquire liquidity swiftly and without substantial delay. Since standardised exchanges characterize free markets, there isn’t any guarantee that firms and buyers will obtain the above-mentioned liquidity of their preferred time-frame. ATS platforms make sure that liquidity isn’t a problem, permitting traders to seek out matching orders for massive asset change offers.

There are several variations of darkish pools, including broker-dealer and exchange-owned versions. For firms and traders who search to determine their favourable prices, broker-dealers are a superior selection. In distinction, exchange-owned dealers simply convert the standardised market prices to execute the dark pool offers. Before the construction of ATS platforms, NYSE and NASDAQ have been clear-cut leaders of the market, which might doubtlessly result in a dangerous oligopoly within the buying and selling subject. Thus, automated buying and selling options were created to offset this development and forestall the domination of any singular exchange platforms.

When forecasting, it’s calculated as the sum of all unit gross sales occasions their promoting price. This is a term used to explain the entire worth or cost of merchandise sold during a selected time period. Liquidity is a crucial concept to understand when trading securities and refers again to the ability of a security to be purchased or sold rapidly and at a good worth. A safety that’s simple to buy and promote is claimed to be liquid. A safety that is tough to purchase or promote is said to be illiquid.

The early type of an Automated Trading System, composed of software program based on algorithms, that have historically been utilized by financial managers and brokers. Since then, this method has been bettering with the event within the IT business. The world of investing is type of a huge metropolis with many ways to get your money working for you.