While the Income Safeguards Program (PPP) was released, countless small enterprises provides rushed to utilize hoping regarding finding bodies financing in order to suffer its businesses from the lingering pandemic . Despite this extreme prominence, there is nevertheless an abundance of suspicion to PPP loans. On the application and investment way to repayment and mortgage-conversion, small business owners try striving to better comprehend the specifics of the latest Paycheck Safety System.

One common concern you to submit-thinking small enterprises enquire about PPP money applies to fees: Is my personal PPP financing taxation-deductible?

The fresh small answer is sure, he’s! The economic Services Work made clear that all providers expenses paid down which have PPP funds are now tax-deductible. The audience is waiting for further Internal revenue service ideas on that it installment loans San Jose Arizona to totally understand the procedure will work.

At the same time, try to very carefully track your entire expenditures to ensure you’re going to be ready to allege such write-offs if the big date comes. You need to already become categorizing their PPP mortgage expenses towards the dos kinds in order to discovered forgiveness. New SBA identifies them since the payroll can cost you and you may most other business costs.

Payroll Will cost you

These kinds provides a name that quickly conjures photo from paychecks, but it’s a whole lot more than simply one. Approved costs into the payroll classification become:

- Settlement in the form of salaries, earnings, earnings, or comparable settlement as much as $a hundred,100000

- Commission of money tips otherwise equivalent

- Commission to have vacation, parental, loved ones, scientific, or sick get-off

- Allowance for dismissal or break up

- Commission off pensions

- Classification vision, dental care, disability, or life insurance policies

- Fee of state or regional taxes assessed towards the payment out-of teams

According to forgiveness regulations discussed because of the SBA, you need to fool around with a minimum of 60% of one’s PPP loan cash on payroll will cost you. If you’ll find reductions on the staff member salaries, the quantity it’s possible to have forgiven ple, a reduced amount of 25% or more into the yearly income getting teams whom generate below $100,100 per year will result in an inferior forgiveness count.

Almost every other Company Expenditures

Just like the identity of payroll will set you back group can make it sound more slim than just it is, the alternative holds true for that it 2nd class. The text other organization expenses voice on the as wide as you can imagine, implying these kinds is some particular connect-all of the. But the SBA has provided a list of certified costs, although the rules include of several beneficial uses for the money, these kinds indeed is not meant for that which you apart from payroll.

- Medical care can cost you related to the fresh extension off classification healthcare professionals throughout symptoms regarding ill, scientific, or family unit members get off, and insurance premiums.

- Financial attention costs ( not prepayment or payment of your mortgage principal)

Perhaps you have realized, many of the company’s operating prices are qualified to receive forgiveness. Just make sure that you track everything you and sustain the details upright so that you can complete just the right paperwork when it is requisite.

Was PPP Money Taxable?

Even if you can allege write-offs to your expenditures financed with mortgage funds is a totally more ball game from the taxability of your own finance themselves. Therefore is actually a PPP mortgage taxable?

PPP loans won’t be taxed from the a national peak, many says have picked out to incorporate the latest financing as the nonexempt earnings. You can check with your state to see even when you are expected to pay state fees to the loan.

Hiring the assistance of Bookkeeping Advantages

While the operator, you have a million one thing on your own dish. You can free up valued time because of the assigning your own bookkeeping to help you an accounting services that may boost reliability and you will save some costs. Including, Sunrise also provides an online accounting unit that will help you stick to best of expenditures so you can be sure you happen to be sticking with new SBA’s expense regulations for PPP money.

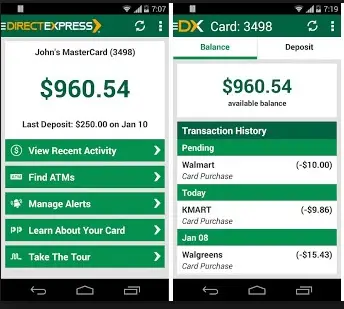

Once you have linked their playing cards and organization savings account, the costs and you will income was automatically classified. That’s true-you no longer need in order to search through receipts and you will stress over the specific elements of your everyday expenses.

Tax seasons definitely seems to lose several of their pain when you yourself have bookkeeping support. You will end up even more ready to accept their yearly filings, as your super-prepared profit make it easier to deduct certified company expenses paid down with your PPP loan. The supplementary benefit is that your own cautious tracking will even assistance your time and effort to obtain the biggest part of your loan forgiven.