Contents

If it does, it’s an obvious failure and we’d want to be out of the trade. You could also use range breakouts, trend line breaks, or simple reversal candlesticks for a trigger. When the indicators are jumbled together, consider the stock to be in transition and wait for better conditions. SMA’s are also preferred for calculating the “close” price on a chart. The Moving Average Indicator is a graphical representation of the average price for a specific timeframe.

By identifying price directions, the EMA allows investors and traders to spot buying and selling signals based on their trading strategy. In summary, Exponential Moving Average trading offers you the flexibility to trade in different market conditions and it provides a complete set of trading rules. The EMA stock trading strategy combines the power of using multiple moving averages of the same periods but using different forms of calculations.

Sign-up to receive the latest news and ratings for Emera and its competitors with MarketBeat’s FREE daily newsletter. The major difference between an EMA and an SMA is the sensitivity each one shows to changes in the data used in its calculation. There are also slight variations of the EMA arrived at by using the open, high, low, or median price instead of using the closing price. Exponential Moving Average is comparable to Simple Moving Average , determining and gauging tendency course of a duration of time.

How to Use the Exponential Moving Average (EMA) in Trading

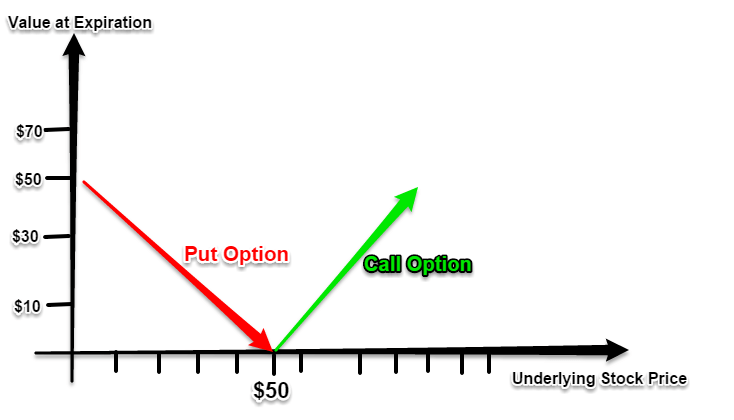

The aim of all moving averages is to establish the direction in which the price of a security is moving based on past prices. They are not predictive of future prices; they simply highlight the trend that is being followed by the stock price. Defined by their characteristic three-dimensional shape that seems to flow and twist across a price chart, moving average ribbons are easy to interpret. The indicators trigger buy and sell signals whenever the moving average lines all converge at one point. EMA chart lines with different periods, such as a 10-period or 100-period EMA, can be used to clearly see stock price trends that may not be apparent in the forest of price bars.

The choice of moving average method depends solely on the investment strategies formulated by traders. But usually, the exponential moving average method gets more preference over simple moving average as it puts more emphasis on recent price points. All traders need to do is analyze each moving average method carefully before incorporating them into their trading practice. For ease of analysis, keep the type of moving average consistent across the ribbon—for example, use only exponential moving averages or simple moving averages. Traders sometimes watch moving average ribbons, which plot a large number of moving averages onto a price chart, rather than just one moving average.

Bearish Exponential Moving Average Crossover Screener

By using this formula, you can calculate the Exponential Moving Average and gain a unique view of the market. Our EMA trading strategy has taken cfa charterholder salary in india advantage of this versatility to create something very unique. Since then, EMA stock has increased by 0.0% and is now trading at C$51.75.

That is, the SMA for any given number of time periods is simply the sum of closing prices for that number of time periods, divided by that same number. So, for example, a 10-day SMA is just the sum of the closing prices for the past 10 days, divided https://1investing.in/ by 10. It is simply the sum of the stock’s closing prices during a time period, divided by the number of observations for that period. For example, a 20-day SMA is just the sum of the closing prices for the past 20 trading days, divided by 20.

It generates electricity through coal-fired, natural gas and/or oil, hydro, wind, solar, petroleum coke, and biomass-fueled power plants. In addition, it transports re-gasified liquefied natural gas from Saint John, New Brunswick to consumers in the northeastern United States through its 145-kilometer pipeline. It also provides insurance and reinsurance services to Emera and its affiliates, as well as offers financing services.

Global Investment

In addition, a long-term moving average will provide an indication of price support and price resistance (when it’s rising). Many traders watch these support or resistance points closely and enter a trade as soon as the price either breaks through the trend line or bounces against it and reverses. Similar to the other moving averages, exponential moving average also acts as resistance and support bands for the prices of a financial instrument. Also referred to as floors, support levels are predetermined prices of financial instruments beyond which they cannot fall.

If you have read or even watched trading-related media, you must have heard about these averages. EMA India Ltd., incorporated in the year 1971, is a Small Cap company (having a market cap of Rs 2.51 Crore) operating in Engineering sector. If we used a lower time frame such as the one hour, we can use a break of a swing high and a cross of the 10/30 EMA combo for our trigger.

- This indicator utilizes two averages, an “EMA” or Exponential Moving Average and an “SMA” or Simple Moving Average.

- A fast EMA is a shorter-period one while a slow one is a longer-dated one.

- Upgrade to MarketBeat Daily Premium to add more stocks to your watchlist.

- Moving average ribbons allow traders to see multiple EMAs at the same time.

At the same time, the EMA puts less weight on the historical price. The EMA recognizes that more recent movements are the most relevant movements and adjusts the weight of data accordingly. The EMA is designed to improve on the idea of an SMA by giving more weight to the most recent price data, which is considered to be more relevant than older data.

Many market participants believe that this offers a better reflection of the current trend of a financial instrument. But there are other traders who suspect that putting excess emphasis on latest data points can bring about more false alarms. Advanced charts with more than 100 technical indicators, tools and studies will give you the edge, making it easier to negotiate the market and its swings.

You may consider buying a stock when the EMA rises and the prices drop just below the EMA or are near it. Similarly, you could sell a stock when the EMA falls, and the prices rally near or just above the EMA. EMA also offers a higher weighting to recent prices, whereas MA assigns equal weight to all values. The moving averages can be used with great success in different scenarios.

Step 4. Coding Setup

Now we need to loop through the numbers that are not in the range of the day length constant and repeatedly calculate the EMA for them and add them to our EMA list. Remember that the first step to calculating the EMA of a set of number is to find the SMA of the first numbers in the day length constant. Continue the process of using the EMA formula for all the numbers in the set and that is how you calculate the EMA of a stock. Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more.

On the other, the exponential moving average tends to reduce the lag provided by the SMA. It does this by adding more weight to the recent prices of an asset. The EMA Moving Averages Indicator is a technical analysis tool used to help investors identify the market’s general direction in the short term. Many traders believe that this indicator accurately represents the actual direction in which the trend is headed.

Setting stops under the low of the pullback and then taking profits at 2X your risk, is a simple approach for traders to start with. You could use a break and close under the 10 EMA for a more scalping exit. A close under the 30 EMA is more of a swing exit and a close under the 50 ends your position trade.

It can, has, and will happen where a very large momentum candle heads to the downside breaking all of the averages in one day. If waiting for the close and depending on the context of the trade, your winner can easily become a loser. Moving averages are specifically good at smoothing out the constant gyrations of price.